Envalue Launches Sustainability Index

Objective Benchmark for Sustainable Real Estate Investments

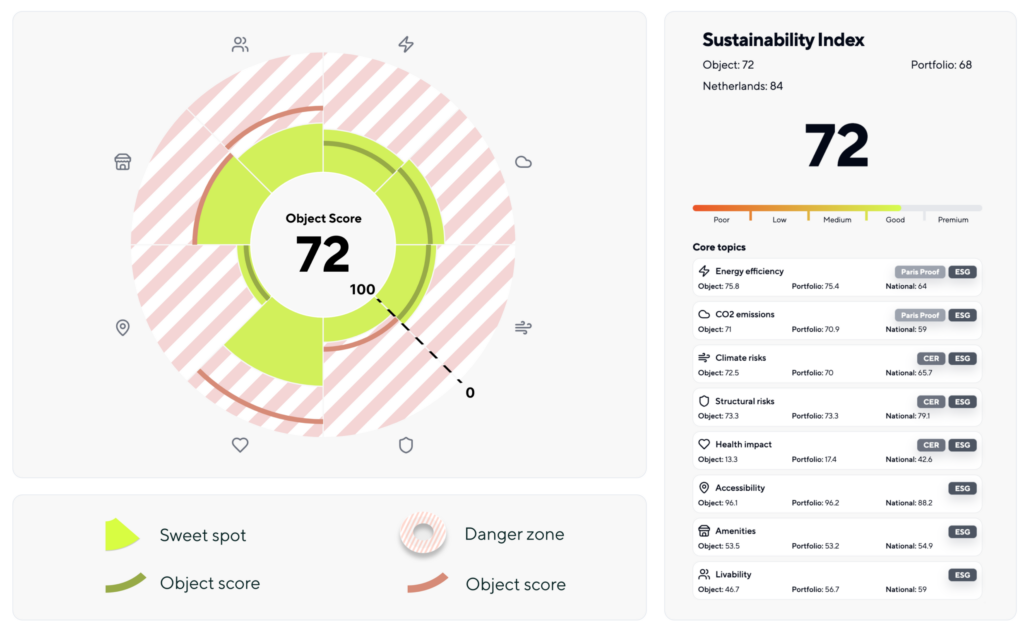

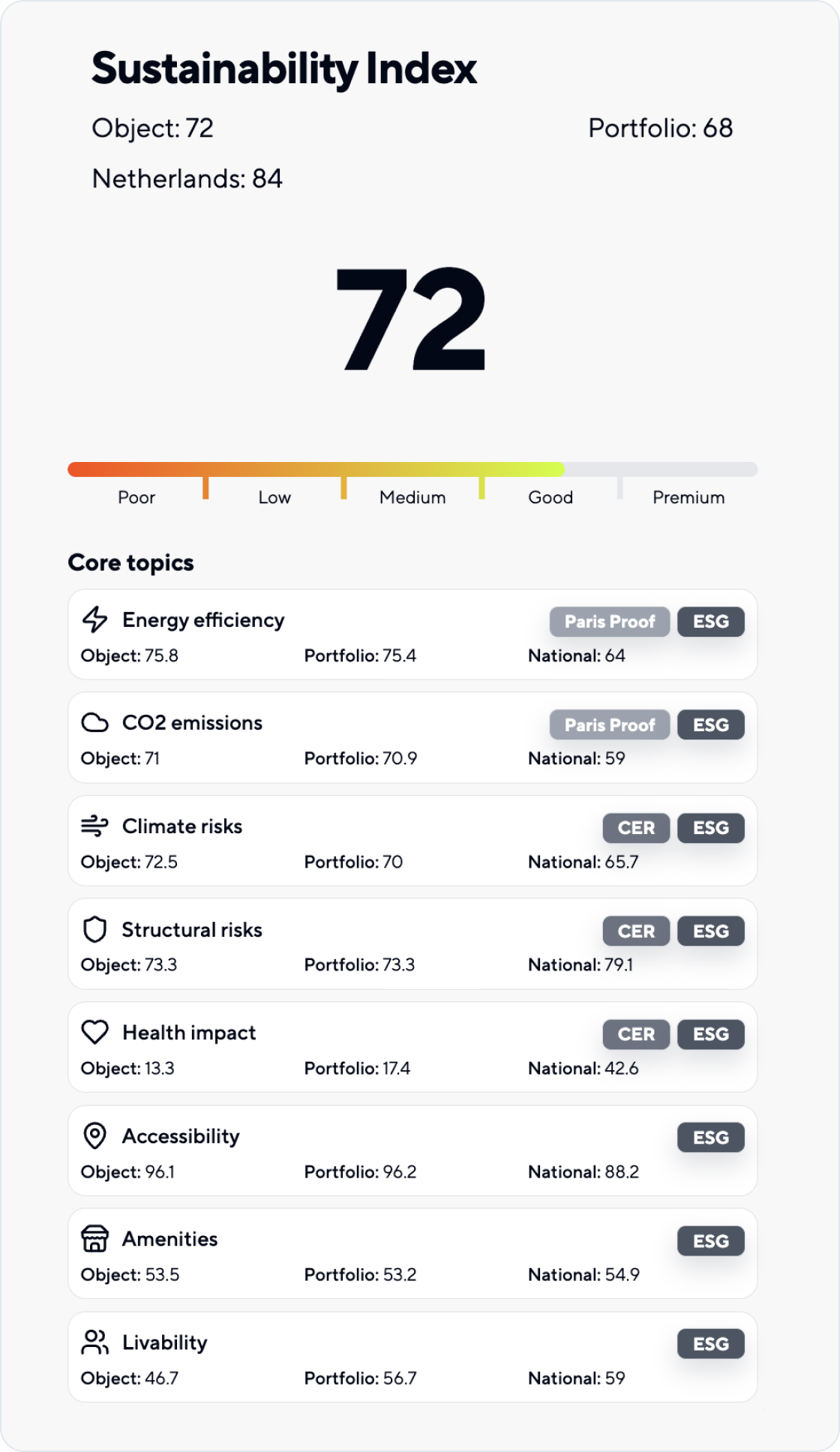

Envalue introduces a Sustainability Index, offering real estate investors and owners an objective, data-driven tool to assess the sustainability of their portfolios. The index is based on 85 weighted data points across eight key categories: energy efficiency, CO2 emissions, climate and natural risks, structural risks, health, environmental impact, biodiversity, and accessibility and amenities. Each property receives an overall score ranging from poor to premium, benchmarked against more than 9.8 million properties in the Netherlands and aligned with EU regulations such as the Taxonomy and CSRD.

From Big Data to Donut Model

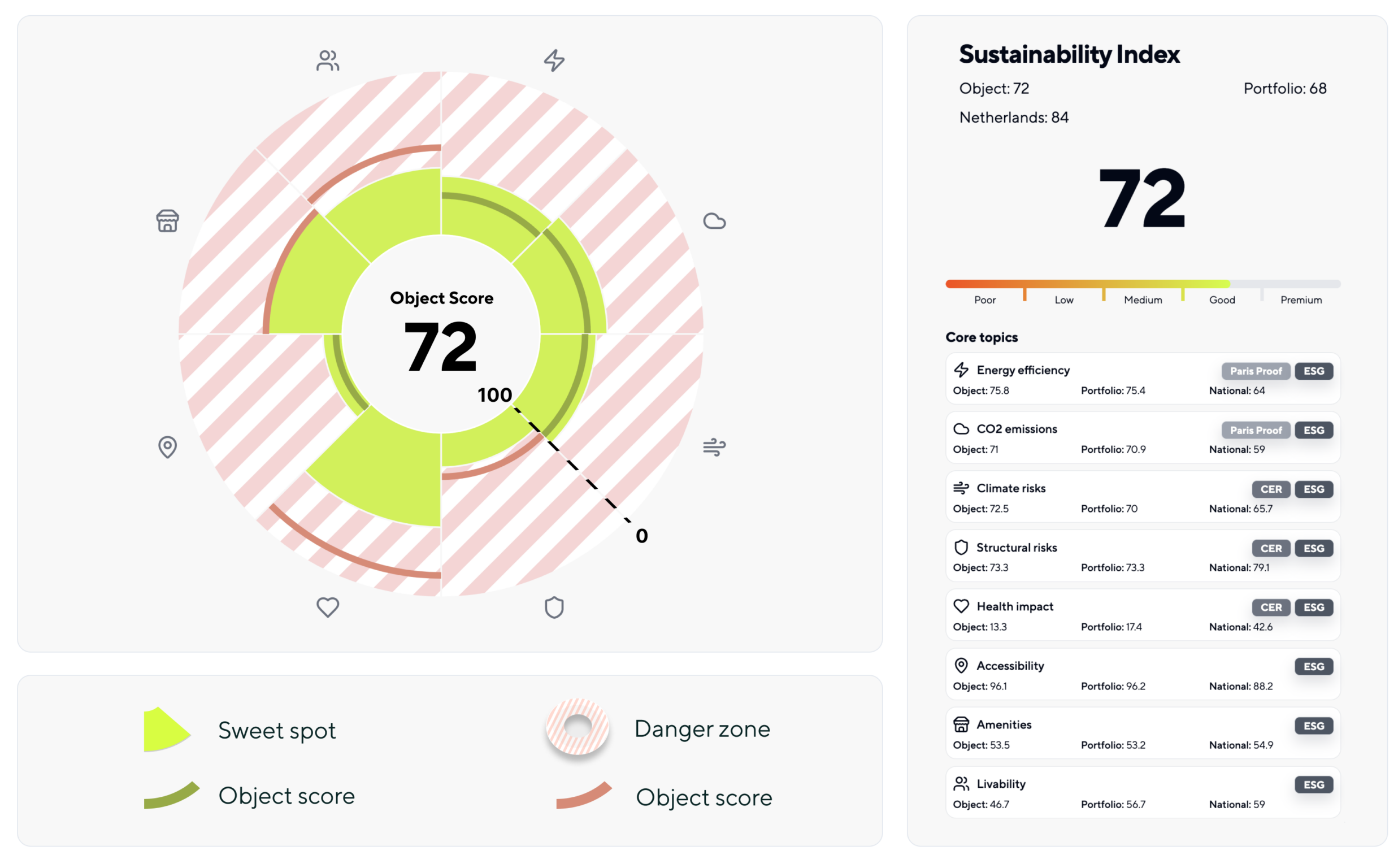

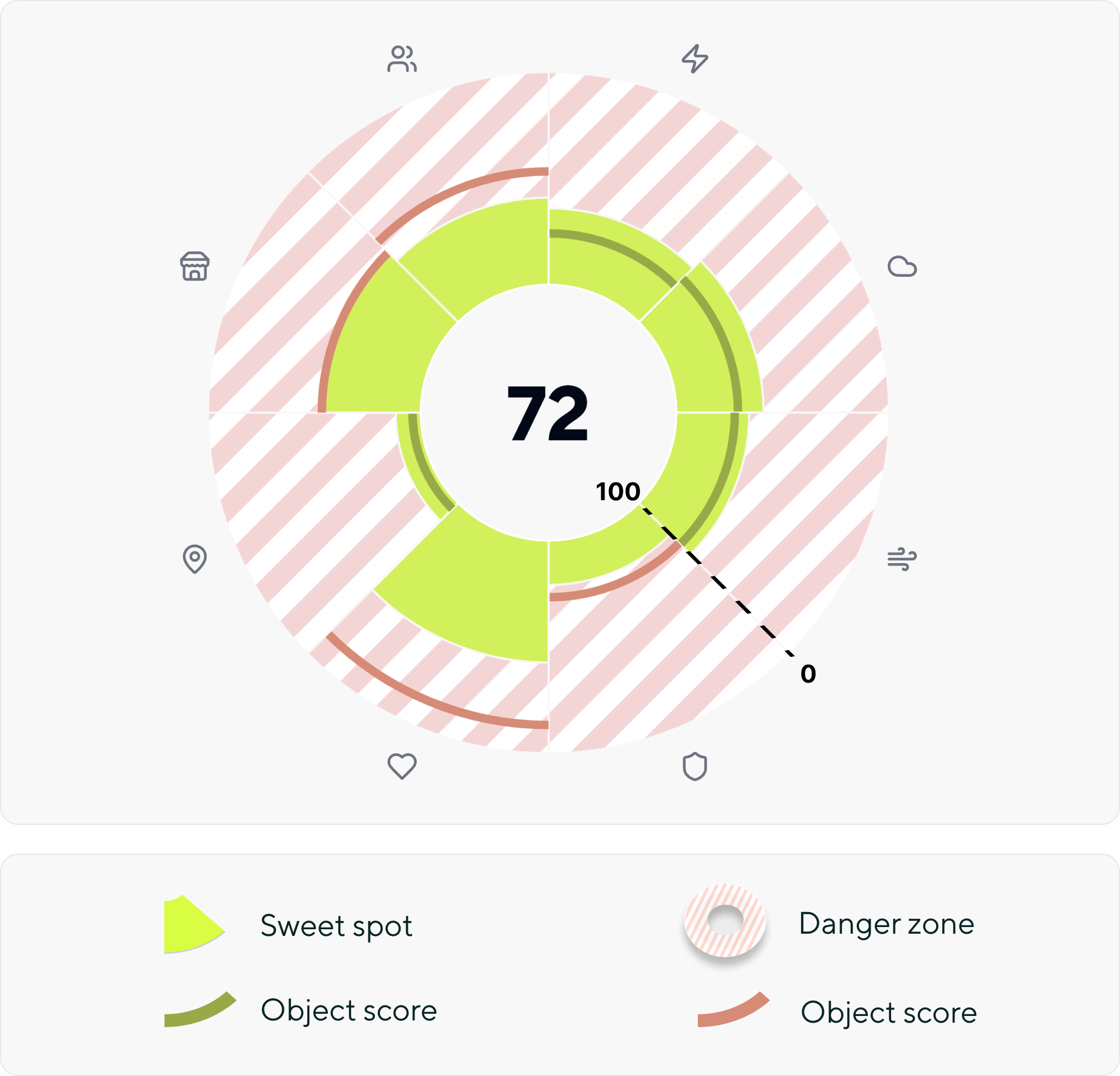

The index features a visual Donut Model, presenting a clear overview of strengths and weaknesses for each property. The inner ring highlights areas that perform well, while weaker aspects fall into the outer ring. According to Cherryl Djoegan, Head of Sustainability at Envalue, “This index is not just another label. It’s a strategic tool that helps investors and property owners make smart decisions to future-proof and enhance the market position of their portfolios. By pinpointing the largest opportunities for improvement, it allows users to effectively focus their resources on impactful sustainability upgrades. Sustainable buildings are more appealing to both tenants and investors, potentially leading to higher returns and competitive advantages.”

Basic and Custom Versions for Flexibility

The Sustainability Index is available in a standard version, offering an objective benchmark for a building or portfolio’s sustainability status. It can be further customized, allowing adjustments to the weighting of categories based on an organization’s specific goals. The benchmark can be applied to the entire built environment or specific portfolios, helping investors meet reporting requirements and make informed sustainability choices.

Impact on the Real Estate Sector

The Sustainability Index is a crucial tool for investors and property owners seeking to enhance their market position while adhering to current and future climate regulations. By combining weighted data, legal alignment, and the Donut Model, Envalue enables organizations to achieve their sustainability targets effectively.